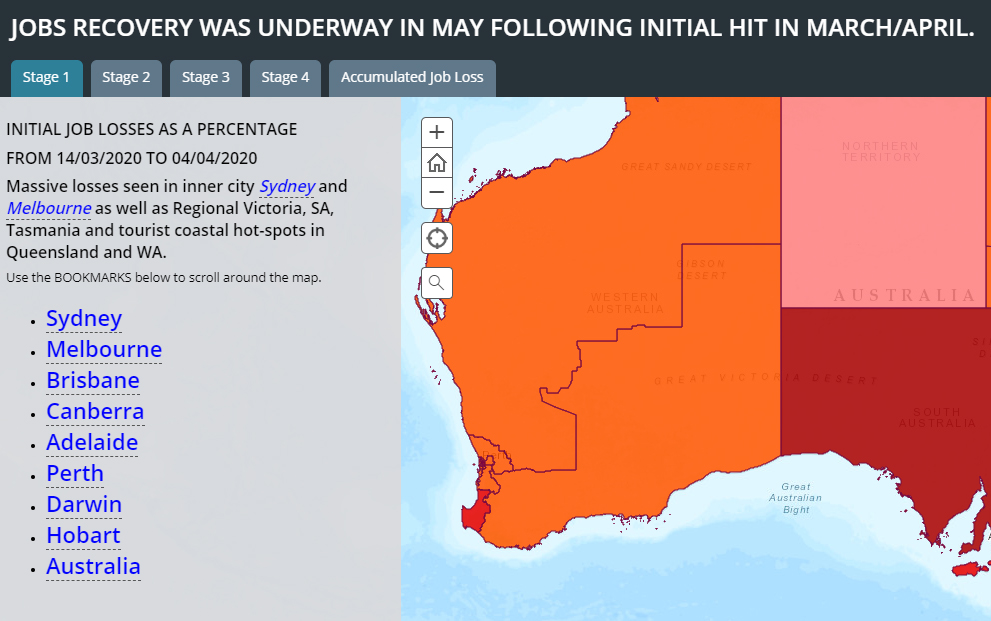

Jobs Recovery Was Underway In May Following Initial Hit In March/April

Category:Health,Labour MarketThe recovery in many jobs was well under way in May. It’s been most pronounced in those hit first in March/April, working in hospitality, young home buyers, young casual workers also studying at TAFE and this is all to the good.

The downturn however continued in May among farming and rural communities, especially fishing (think lobsters in cargo holds of international tourist flights). This has impacted coastal and many rural communities.

The overall picture from March to the end of May shows mainstream suburban families (married, middle aged, with a mortgage and kids at school, two jobs that they really need, and going to church occasionally) to have been much less affected by Covid or by the follow-up lockdowns – down about five percent. These are the groups which weren’t picked up in the polls before the last election and which re-elected Scott Morrison as PM.

The groups in deepest trouble (ten percent plus loss over jobs) over the period March to May were – despite a recovery in May – still the workers in casual hospitality and arts & rec jobs (agnostics, twenty somethings, living in small rental units, single, agnostics, no kids, Green voters).

So, good is down only five percent and getting better slowly. Bad is ten percent and getting worse slowly. Spatially, Tasmania looks pretty awful, as do many rural and coastal communities, but the really horrible bits on the map are the inner-city suburbs, particularly in Melbourne and Sydney, where Covid cases have been most concentrated.

Because the jobs lost in many cases have been second or third casual jobs and less well paid, the impact of jobs lost to the economy has been a bit overstated and has actually increased average incomes per job in many suburban areas, especially with large public sector payrolls.

This is, however, pretty cold comfort, for those relying on Government handouts and counting down to the end of September.

What was the real rate of unemployment in May? The short answer is 11.5 percent. This is obtained by maintaining the pre-Covid lockdown participation rate at the March level of 66.2 percent and applying this to the Civilian population 15 years and over, producing a potential workforce of up to 13, 770,061 in May. The combined numbers of officially unemployed and those who dropped out was 1,579,639. We used original or unadjusted figures as seasonal adjustments have become overwhelmed by Covid lockdowns and only original figures are used spatially for smaller areas. The original unemployment figure was marginally higher at 11.7 percent and 12.1 percent respectively in January and February 1993.

The figure of 11.5 percent also resonates with the new and more immediate ABS series on Weekly Payroll Jobs and Wages, which shows 5.6 percent of main jobs were lost between March 14 and the end of May and the official March unemployment rate was 5.6 percent in March. The two figures sum to 11.2 percent.

This means the current unemployment rate is as bad now as it was during the worst of the recession in the early 1990’s. The unemployment figure then was marginally higher at 11.7 percent and 12.1 percent respectively in January and February 1993.

The current figures for the one touch payroll data have been recovering slowly from the initial impact of the Covid jobs lockdown in early April, and this 11.2 percent hybrid figure is likely to continue (barring a second wave starting off from Victoria) at least until the Government begins to wind back JobKeeper and JobSeeker in September.

The realistic figure for unemployment rates at that time will be determined by whether the rate of recovery exceeds the rate at which those now on JobKeeper or JobSeeker join the ranks of those actively seeking work and satisfying the ABS definition of being unemployed.

The official ABS labour market unemployment rate is now pretty meaningless, as participation rates will tend to decline with relatively older and younger workers dropping out of the labour market.

In fact, the first sign of a recovery in a recessed regional labour market can be an interim increase in the local unemployment rate, as formerly discouraged workers are encouraged to seek work by becoming officially unemployed on a temporary basis, while actively hunting for a job and hence immediately boosting participation rates and then growing employment in the longer term.

So the most useful indicators you should be watching for in coming months are total jobs lost and gained by region and accompanying movements to participation rates.

Text by John Black, founder of ADS and EGS. Maps by Dr. Jeanine McMullan, CEO of Health Geographics.